What are stocks?

A stock is a security that represents the ownership of a fraction of a corporation. This entitles the owner of the stock to a proportion of the corporation’s assets and profit equal to hoe much stock they own. Units of stocks are called shares.

What are Forex?

The foreign exchange market or Forex is the international market on which currencies are traded with each other. The currencies that are traded the most are referred to as Majors. These Majors are responsible for over 85% of the daily trades in the Forex market. There are 7 Majors.

| The seven majors: |

| USD – US Dollar |

| AUD – Australian Dollar |

| GBP – Great Britten Pound |

| CAD – Canadian dollar |

| EUR – Euro |

| JPY – Japanese Yeng |

| CHF – Swiss Frank |

Forex trading is the conversion of one currency to another. There are 3 types of Forex markets:

Spot Forex markt:

The physical exchange of a currency pair that takes place at the exact moment the transaction is settled.

Forward Forex markt:

A contract is agreed to buy or sell a specified amount of a currency at a specified price for settlement on a specified future date.

Future Forex markt:

A contract is agreed to buy or sell a specified amount of a currency at a specified price and on a specified future date. Unlike Forwards, a Future is legally binding.

Most traders who speculate on Forex prices do not receive the currency itself, instead they make forecasts of exchange rates in order to take advantage of price movements in the market.

What are crypto?

Crypto is value in the form of an amount in crypto currency. This is a type of digital currency, which is often used as an alternative money system for the regular currencies. The world’s most famous crypto currency is Bitcoin (BTC). To what extent crypto currency is really money is controversial.

Bitcoin does have the legal status of a medium of exchange, but not that of money. The market capitalization of crypto currency stands at USD 2,000 billion in early 2021.

What are CFD’s ?

A contract for diffrence is a contract between two parties, usually described as the “buyer” and the “seller”, where the seller pays the difference between the value of an underlying product upon purchase and sale. When this difference is negative, the buyer pays the seller. With CFDs, the trader never becomes the owner of the underlying asset.

What are Turbo’s?

A Turbo is an investment product that gives investors the opportunity to invest with leverage in various underlying assets such as shares, stock market indices, currencies, bonds, commodities and investment funds. Turbos are developed by the ABN-AMRO Bank.

What are Bonds?

A Bond is a negotiable debt instrument. If a company needs money, it can get it by issuing bonds. The buyer of the bond will receive interest from the company for the money they received when the Bond was issued.

What are effects?

Securities are negotiable rights that represent a financial value, such as shares, bonds, options and forward contracts. The current price of Securities is called the price.

What are Options?

An Option is the right to buy or sell a specific good within a specified time. Whoever takes a buy Option on a particular good has not yet bought that good. However, he does have the option to buy this good within the agreed period. The seller may not sell this property to another person within the agreed term.

Who takes a buy Option on a share buys the right to buy the share for a predetermined price. For this, the taker of the Option must pay an amount to the person who grants this right.

What are Option strategies?

Call option:

This is a financial product that gives the buyer the right to buy the product with a predetermined price. In addition, the date of sale is also recorded. The amount for which the Option is sold is called the option premium.

Put Option:

A put option gives the buyer the right to sell the financial product at a predetermined price. The date of sale is also predetermined.

| Call Option | Put Option |

| Right to buy financial product | Right to sell financial product |

Option strategies are combinations of Options with which one can accurately anticipate expected movements of financial products. It offers more options than Loose Call Option or Put Option.

What is investing?

Investing is ideal for people who want to build up a certain amount of capital for the long term. This can be in stocks, real estate, bonds and government projects. You can have your investment committed for a specific period. In many cases, your private assets will have increased after this period.

An example of this is investing in the realization of senior housing, where you will receive an X percentage of interest per year on your investment and after 7 years you will receive your full investment back.

This form of investing brings a lot of security, but there is more to be earned on the stock market in a considerably shorter time frame. Just keep in mind that you know what you’re doing before you start.

What is Scalping?

Scalping is the quick buying and selling of financial instruments within minutes with the aim of making small profits. So you open a position and if the price rises you close it again. You do this multiple times every minute and with that you earn many small amounts.

Scalping is not prohibited by law, however, there is a considerable chance that the broker will block your accaunt if it is observed

What is Hedging?

That is the hedging of a financial risk of an investment by means of other investments. A good example of Hedging is taking an Option.

What is Daytrading?

Day trading is nothing more than buying and selling shares within a very short period of time. Actually within 24 hours. Daytrading can be done on all markets but it is best to do this on a market where an ann and sales activity takes place. This is because you earn on this.

What is going Short?

Going short is selling a share that one does not own, in order to earn money from a fall in a share price. Long a Buy position then earns money from the rise in a share price. Short a Sell position, then one earns from the fall in a share price.

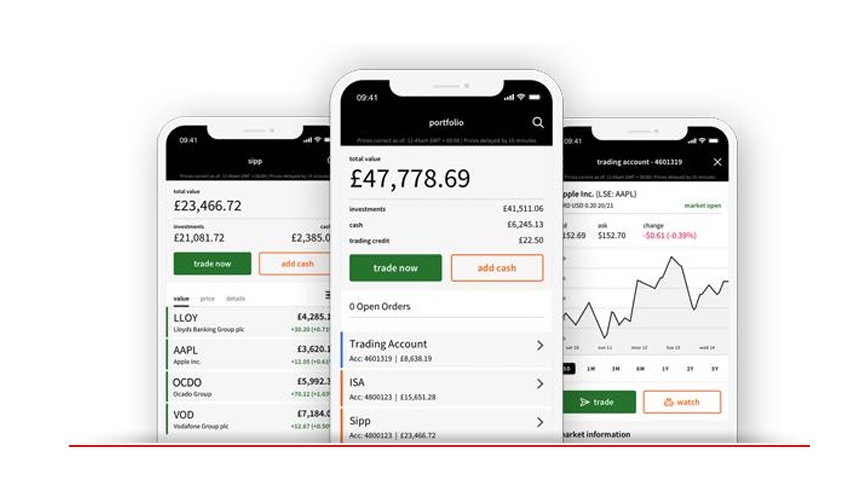

How tot trade on a mobile platform?

If you want to start trading in your application, there are several strategies you can apply. Choose the strategy that works best for you, depending on your goals. If you want to make money in the short term, it’s best to choose a day trading option.

If you want to make sure you make money in the long run, it’s best to invest and store your stock for a long time. The former usually applies when trading on trading platforms. Let’s see how it works.

Download the trading application, install it on your mobile phone or computer, and then create an account. Then you can choose what to trade with. Beginners should start with Forex or CFD. If you have no experience yet, do not trade in the cryptocurrency market.

The reason for this is that the market is very volatile and the purchase cost (spread) is high.

Forex deals with foreign currencies. For example, in the Forex overview, you can choose the position of EUR / USD.

This means that you can open a euro position against the US dollar. You can choose a sell or buy position depending on this Forex course. If you see the euro weakening against the US dollar, it is wise to open this position as a sell LOT.

However, if the euro is stronger than the US dollar, it is best to open this position as a Buy LOT. In this way, you can earn from both rising and falling prices. This is done by selecting a buy / sell option. This is the basis of the trading process on the intermediary platform.